betterment tax loss harvesting joint account

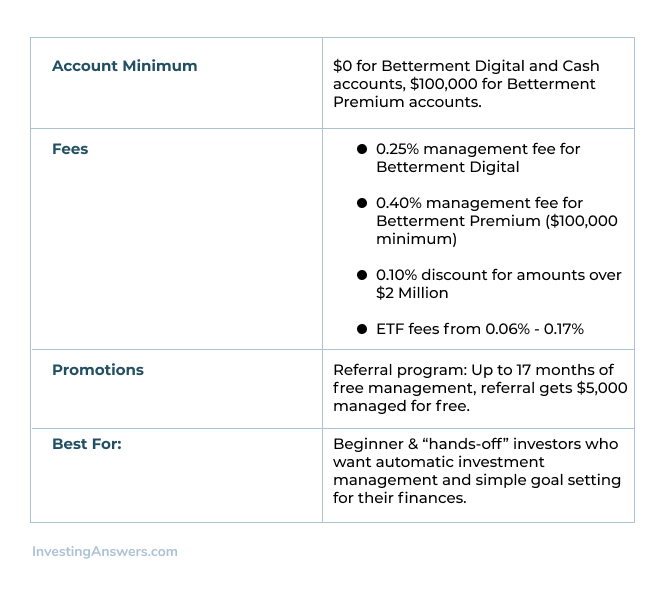

California voters have now received their mail ballots and the November 8 general election has entered its final stage. Fees are taken right from your Betterment Investing account at the end of each month.

Betterment Review Automated Investing And Robo Advisor

Betterment invests your money in low-fee index.

. Betterment for example allows clients to purchase individual financial advising sessions and Personal Capital Wealthsimple and Betterment provide regular financial planning for clients with. This is a great way to maximize your investing dollars with little effort. While you can certainly use tax-loss harvesting with passive investing the amount of trading that takes place with active investment strategies may create more.

Exclusive investments and strategies available. Here is a breakdown of all the credits and deductions a dependent might help with. Both Wealthfront and Betterment offer tax-loss harvesting for their taxable accounts while making sure to avoid wash sales.

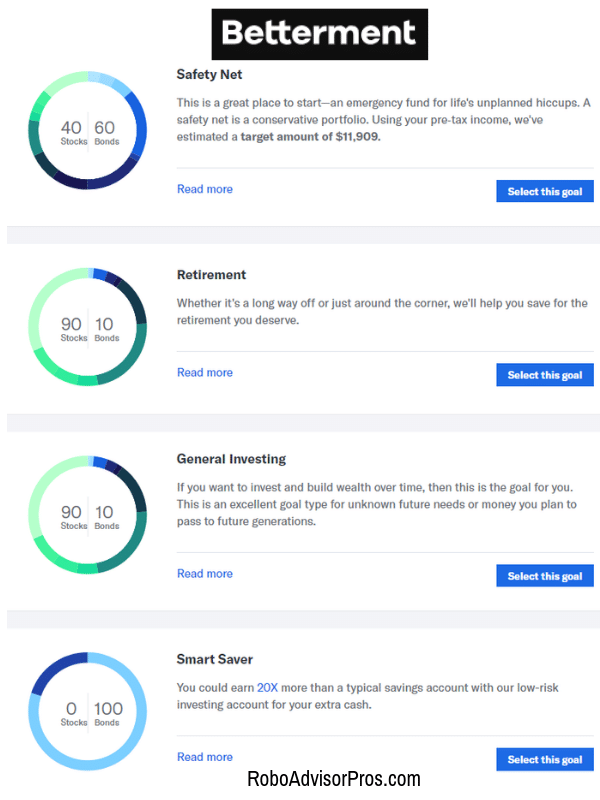

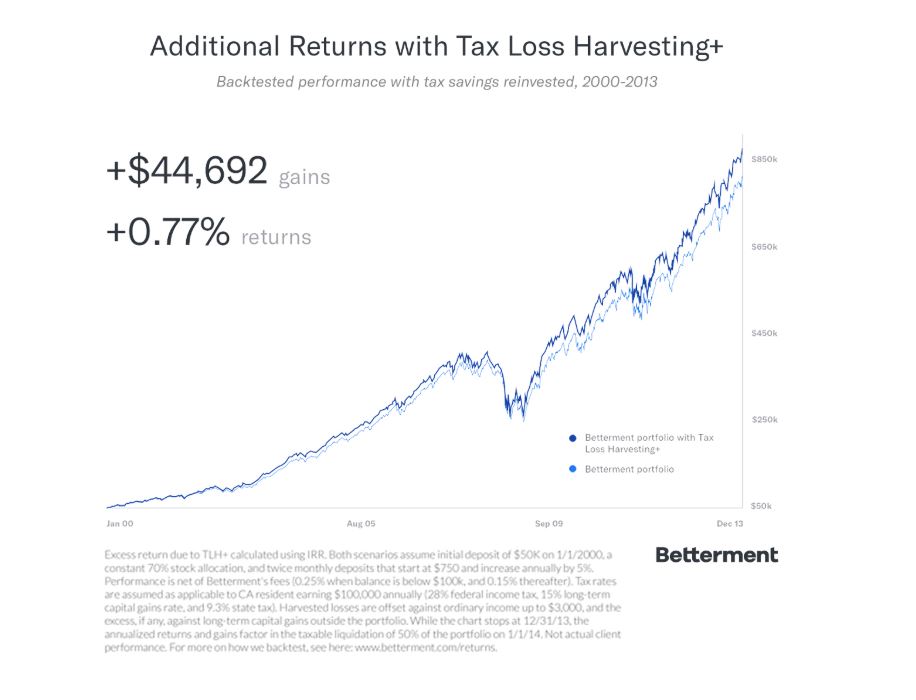

The IRS allows individuals to give away a specific amount of assets or property each year tax-free. This is called tax-loss harvesting. Betterment offers other features such as Smart Saver automated rebalancing and tax-loss harvesting.

This process minimizes taxes by selling losing investments to offset. The holding will call into question many other regulations that protect consumers with respect to credit cards bank accounts mortgage loans debt collection credit reports and identity theft tweeted Chris Peterson a former enforcement attorney at the CFPB who is now a law. Including for tax-loss harvesting.

Betterment is an expenditure that improves an assets performance or increases its value. NW IR-6526 Washington DC 20224. If youre planning to use ETFs to save for college a 529 account is a good place to start.

Or B Contiguous to and on January 1 2015 under the same ownership as the tax lot on which the school was established. Several individual and joint account. Your contributions are tax deductible and your account balance grows tax deferred.

Amid rising prices and economic uncertaintyas well as deep partisan divisions over social and political issuesCalifornians are processing a great deal of information to help them choose state constitutional officers and. Betterment Read 62 Reviews. Advice and planning tools.

Investing Simple is affiliated with Betterment and M1 Finance. The wash sale rule prohibits an investor from taking a tax deduction if they sell an investment at a loss and repurchase the same investment or a substantially identical one within 30 days. SoFi does not offer tax-loss harvesting an investment strategy that can significantly reduce capital gains taxes.

And d The school is a public or private school for kindergarten through grade 12. Tax-loss harvesting is a method of rebalancing your portfolio holdings to limit capital gains taxes. While theres a relatively high.

In 2022 the annual gift tax exemption is 16000 meaning a person can give up 16000 to as many people as he or she wants without having to pay any taxes on the gifts. Opt for Funds Over Individual Stocks. If you have funds jointly owned these funds would be separately insured for up to 250000 for each joint account owner.

If you opened an Acorns Personal account the one. A tax credit reduces the amount of tax you owe on a dollar-for-dollar basis and some tax credits are refundable. In taxable accounts the practice involves selling losing investments to offset.

C The expansion occurs on a tax lot. The FICA tax is 153 paid by employers and employees who split the burden by each paying halfEmployers pay 765 and their employees pay 765. That means the impact could spread far beyond the agencys payday lending rule.

If you used Betterment which charges an annual percentage of 025 for its basic Betterment Digital offering your annual cost would be 025. A tax deduction lowers your taxable income so that you owe less tax for the year. Annual Gift Tax Exclusion.

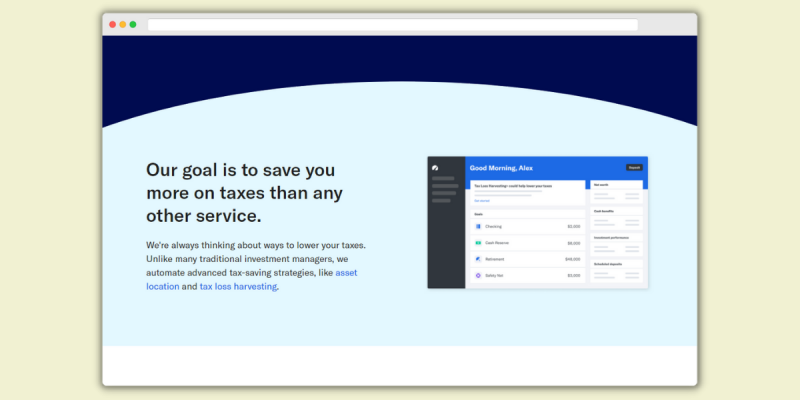

Advanced tax-saving strategies like tax loss harvesting and asset location. You can send us comments through IRSgovFormCommentsOr you can write to the Internal Revenue Service Tax Forms and Publications 1111 Constitution Ave. If you have funds jointly owned these funds would be separately insured for up to 250000 for each joint account owner.

Most passive investors do so through a retirement account and M1 Finance offers these for free with a minimum balance of 500. Vanguard Personal Advisor Services is a robo-advisor tailored to the needs of people who have a well-established nest egg and may be getting closer to retirement. General repair or maintenance to sustain an assets current value is not considered betterment and those.

Seasoned investors know that a time-tested investing practice called diversification is key to reducing risk and potentially boosting returns over time. Tax loss harvesting is an investing strategy that can turn a portion of your investment losses into tax offsets helping turn financial losses into wins. In 1935 the federal government passed the Federal Insurance Contribution Act FICA which established taxes to help fund Social Security and Medicare.

Doesnt have features like tax-loss harvesting that more experienced investors may want Disclosures All investing is subject to risk including the possible loss of the money you invest. Money held in a 529 grows tax free and wont be taxed on withdrawal as long as its used for. Tax-loss harvesting program.

Tax credits are typically deemed to be more favorable to most people. We welcome your comments about this publication and suggestions for future editions. Platforms like Betterment and.

Self-Employment Tax Definition. Not ideal for casual investors. A On which the school was established.

Nbkc bank utilizes a deposit network service which means that at any given time all none or a portion of the funds in your Betterment Checking accounts may be placed into and held beneficially in your name at other. Betterment offers automatic tax-loss harvesting¹ as a standard feature.

Betterment Review 2022 The College Investor

Betterment Review 2022 What You Need To Know About This Robo Advisor

Betterment Review Smartasset Com

Betterment Review Is This Robo Advisor Right For You

Betterment Review Pros Cons And Who Should Set Up An Account

Betterment Review 2022 The Best Robo Advisor For Beginners

Betterment Review Expert Guide And Analysis

Betterment Review 2022 The Best Robo Advisor One Shot Finance

Betterment Vs Ellevest Which Ira Is Right For You

:quality(70)/cloudfront-eu-central-1.images.arcpublishing.com/xlmedia/TZ3BDRD4MZBJNGTPAGH4CDKOJA.png)

Betterment Review 2021 The Original Robo Advisor The Dough Roller

Betterment Vs Wealthfront Which One Should You Choose

A Detailed Review Of Betterment Returns Features And How It Works

Betterment Review 2022 A Robo Advisor Worth Checking Out

M1 Finance Vs Betterment Which Investing Service Is Better

Betterment Review Smartasset Com

:max_bytes(150000):strip_icc()/betterment-vs-vanguard-4f74415b96a34269b6671a8706391df0.jpeg)

Betterment Vs Vanguard Personal Advisor Services Which Is Best For You

:max_bytes(150000):strip_icc()/betterment_inv-f807c64202ac48a9a5a7dcfe4f2e6205.png)